Installment Payments

Installment Payments are scheduled payments which terminate after the last scheduled payment is made. They are most often used in education (eg. classes) or to manage major gifts for an organization and they work for both Purchases and Donations. Presspoint manages the entire process internally, regardless if the payment method is a credit card or another “offline” method like cash or check.

How it Works

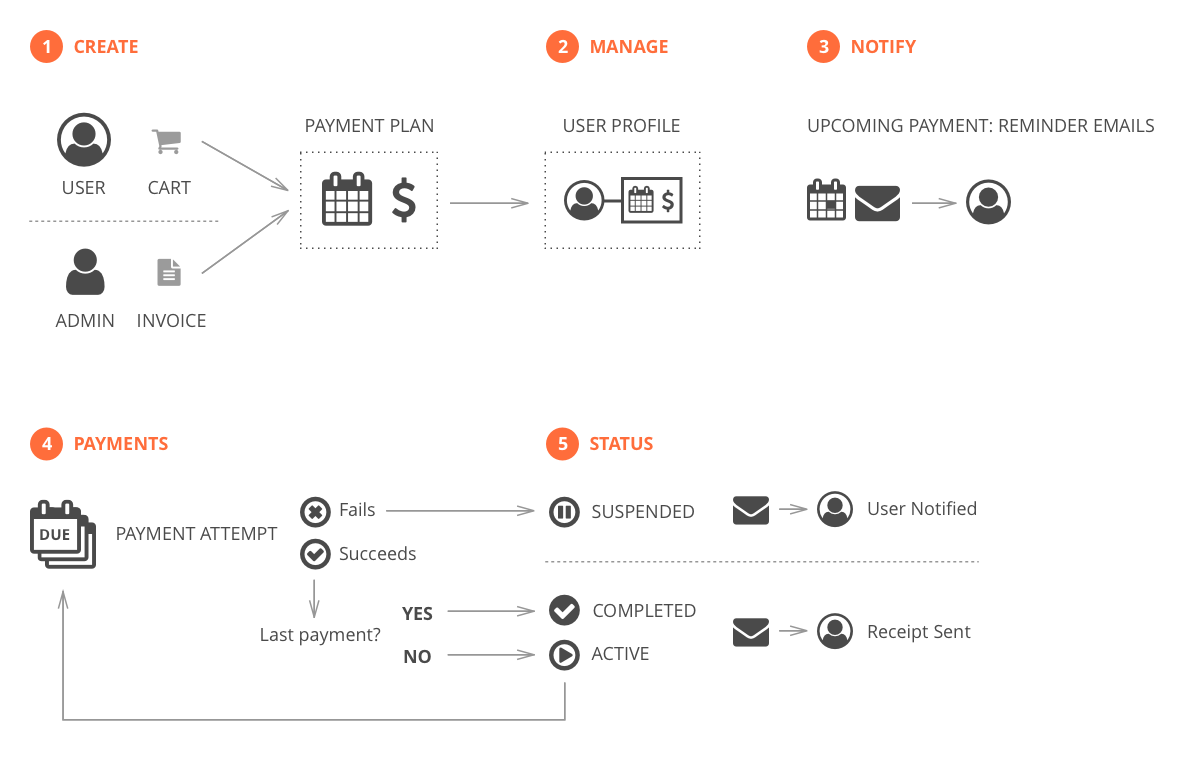

When a user makes a Donation or a Purchase and the item is set as an Installment Plan, Presspoint creates a Payment Plan on the user’s account that contains all of the details for the how the plan will be paid, what the current status of the payment schedule is and opportunities to adjust the plan as necessary. If a plan is renewed, Presspoint adds a “child” payment to the existing Payment Plan.

Basic Lifecycle

- Create Plan. A plan is created either through the shopping cart system by the user or, through the invoicing system by an administrator.

- Manage Plan. The plan is stored in the user’s profile and can be accessed by the user at any time by logging in to their account. A user can cancel a payment plan at any time.

- Notifications. When a scheduled payment is coming up, an email can automatically be sent as many days in advance as you wish. The email can be customized using Presspoint Autoresponders.

- Payment. On the payment date, payment is attempted. If the plan has a credit card attached to it and automatic payments are enabled, a charge will be attempted and, on success, a receipt will be sent while on failure a notice will be sent advising the user on what to do. In the event that the payment method is not a credit card, no payment will be attempted and a notice will be sent to the user advising them that their account will be suspended.

- Status. If the payment is successful and it is not the last scheduled payment, the Payment Plan’s status remains as “Active.” If the payment fails, the Payment Plan’s status is set to “Suspended” for a period of time set by you after which, if a payment is still not made the Payment Plan’s status is set to “Expired.” If the payment is successful and is the last payment, the status is transitioned to “Completed.”

Tip: Using the “Status” Field in Reports

With the status field, you can create very simple queries in Reports that look at a particular item and its current status to provide a list of, for example, “current students” or “active grants.” The benefit in so doing is that as plans change status, your list is automatically updated and can serve as a reliable means of managing disparate schedules.

Managing an Installment Payment Plan

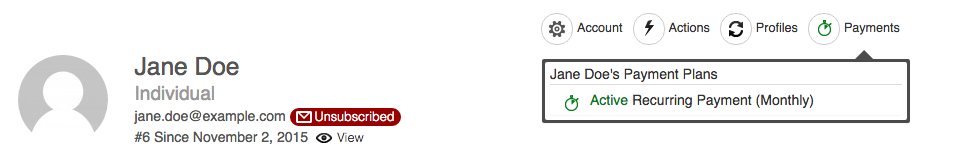

Payment Plans are accessible to the user from the action bar at the top-right of the user’s profile.

Viewing a plan is much like viewing a receipt, however, scheduled payments appear as “child” payments at the bottom of the receipt, much like a transcript. You can still search on the individual payments but clicking on any “child” payment will always bring up the view of the Payment Plan.

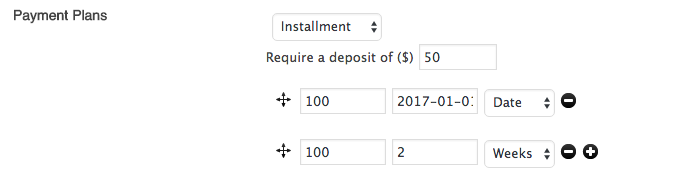

Setup Installment Payment Plans

For Installment Payments, you have the option of specifying how many installments there will be by adding lines to the option. For each line, you can specify how many units of time (eg. 5 days or 7 weeks) or an exact date the system should use to project when a future payment will occur. When processed, Presspoint will create actual payment receipts on the Payment Plan with a status of “Pending” that will be transitioned to “Completed” once payment is received. You also have the option to specify a “deposit” amount that is collected at checkout.